Maximum Drawdown or Maximum Loss

maxdrawdown.RdThis function computes the maximum drawdown or maximum loss of the

univariate time series (or vector) x.

maxdrawdown(x)Details

The max drawdown or max loss statistic is defined as the maximum

value drop after one of the peaks of x. For financial

instruments the max drawdown represents the worst investment loss for

a buy-and-hold strategy invested in x.

Value

A list containing the following three components:

- maxdrawdown

double representing the max drawdown or max loss statistic.

- from

the index (or vector of indices) where the max drawdown period starts.

- to

the index (or vector of indices) where the max drawdown period ends.

See also

Examples

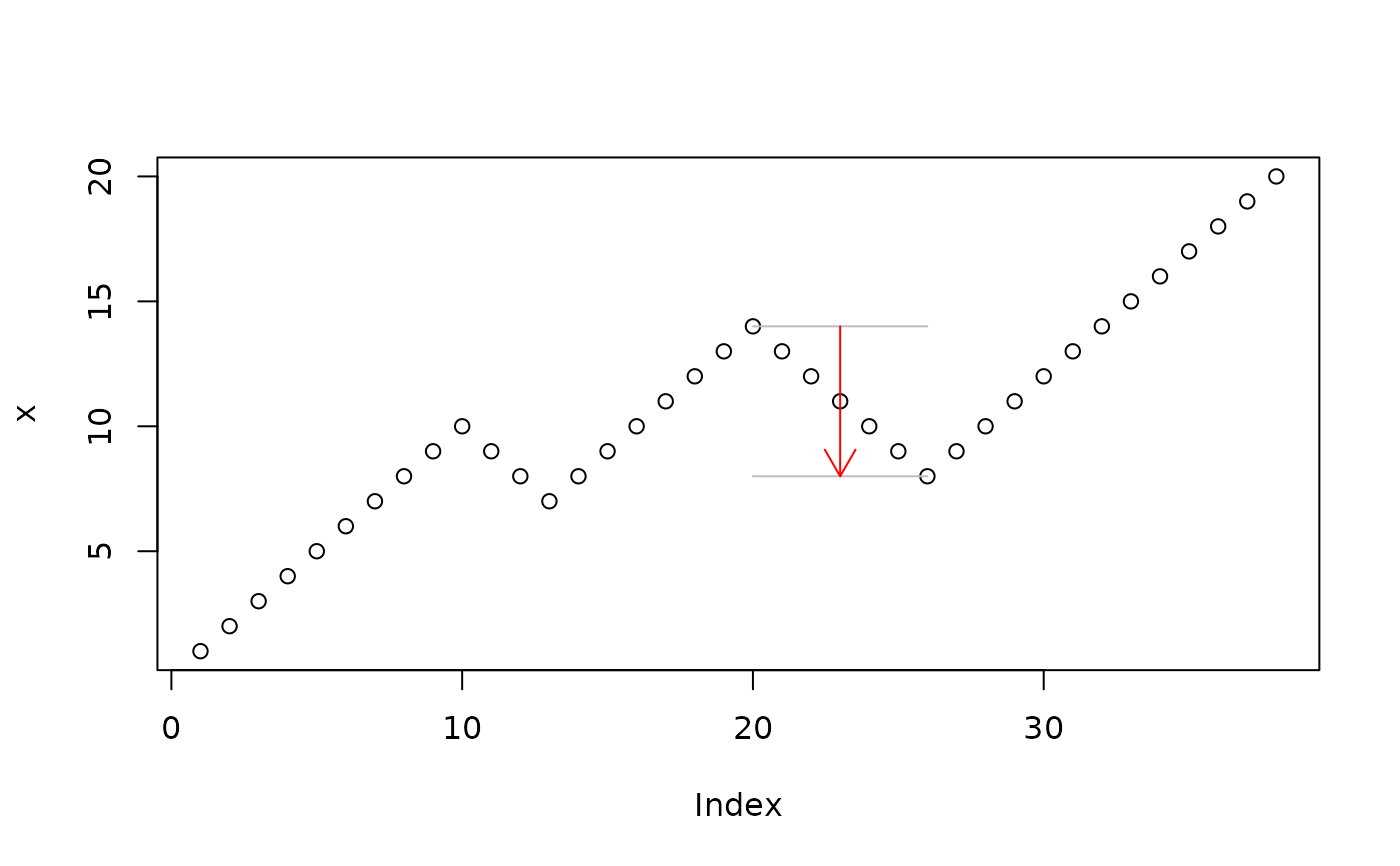

# Toy example

x <- c(1:10, 9:7, 8:14, 13:8, 9:20)

mdd <- maxdrawdown(x)

mdd

#> $maxdrawdown

#> [1] 6

#>

#> $from

#> [1] 20

#>

#> $to

#> [1] 26

#>

plot(x)

segments(mdd$from, x[mdd$from], mdd$to, x[mdd$from], col="grey")

segments(mdd$from, x[mdd$to], mdd$to, x[mdd$to], col="grey")

mid <- (mdd$from + mdd$to)/2

arrows(mid, x[mdd$from], mid, x[mdd$to], col="red", length = 0.16)

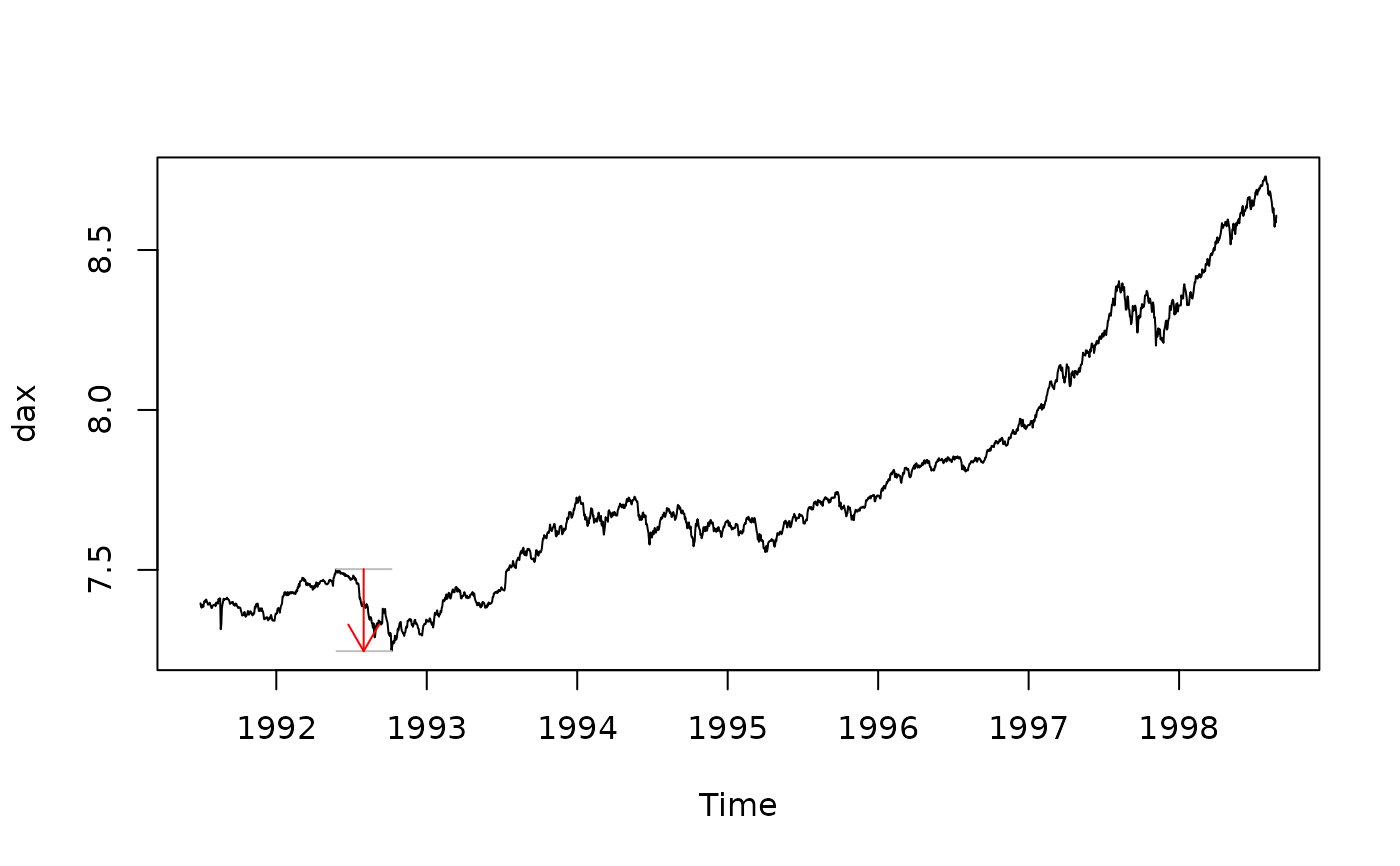

# Realistic example

data(EuStockMarkets)

dax <- log(EuStockMarkets[,"DAX"])

mdd <- maxdrawdown(dax)

mdd

#> $maxdrawdown

#> [1] 0.256471

#>

#> $from

#> [1] 236

#>

#> $to

#> [1] 331

#>

plot(dax)

segments(time(dax)[mdd$from], dax[mdd$from],

time(dax)[mdd$to], dax[mdd$from], col="grey")

segments(time(dax)[mdd$from], dax[mdd$to],

time(dax)[mdd$to], dax[mdd$to], col="grey")

mid <- time(dax)[(mdd$from + mdd$to)/2]

arrows(mid, dax[mdd$from], mid, dax[mdd$to], col="red", length = 0.16)

# Realistic example

data(EuStockMarkets)

dax <- log(EuStockMarkets[,"DAX"])

mdd <- maxdrawdown(dax)

mdd

#> $maxdrawdown

#> [1] 0.256471

#>

#> $from

#> [1] 236

#>

#> $to

#> [1] 331

#>

plot(dax)

segments(time(dax)[mdd$from], dax[mdd$from],

time(dax)[mdd$to], dax[mdd$from], col="grey")

segments(time(dax)[mdd$from], dax[mdd$to],

time(dax)[mdd$to], dax[mdd$to], col="grey")

mid <- time(dax)[(mdd$from + mdd$to)/2]

arrows(mid, dax[mdd$from], mid, dax[mdd$to], col="red", length = 0.16)