Pension Funds Data

pension.RdThe total 1981 premium income of pension funds of Dutch firms, for 18 Professional Branches, from de Wit (1982).

data(pension, package="robustbase")Format

A data frame with 18 observations on the following 2 variables.

IncomePremium Income (in millions of guilders)

ReservesPremium Reserves (in millions of guilders)

Source

P. J. Rousseeuw and A. M. Leroy (1987) Robust Regression and Outlier Detection; Wiley, p.76, table 13.

Examples

data(pension)

plot(pension)

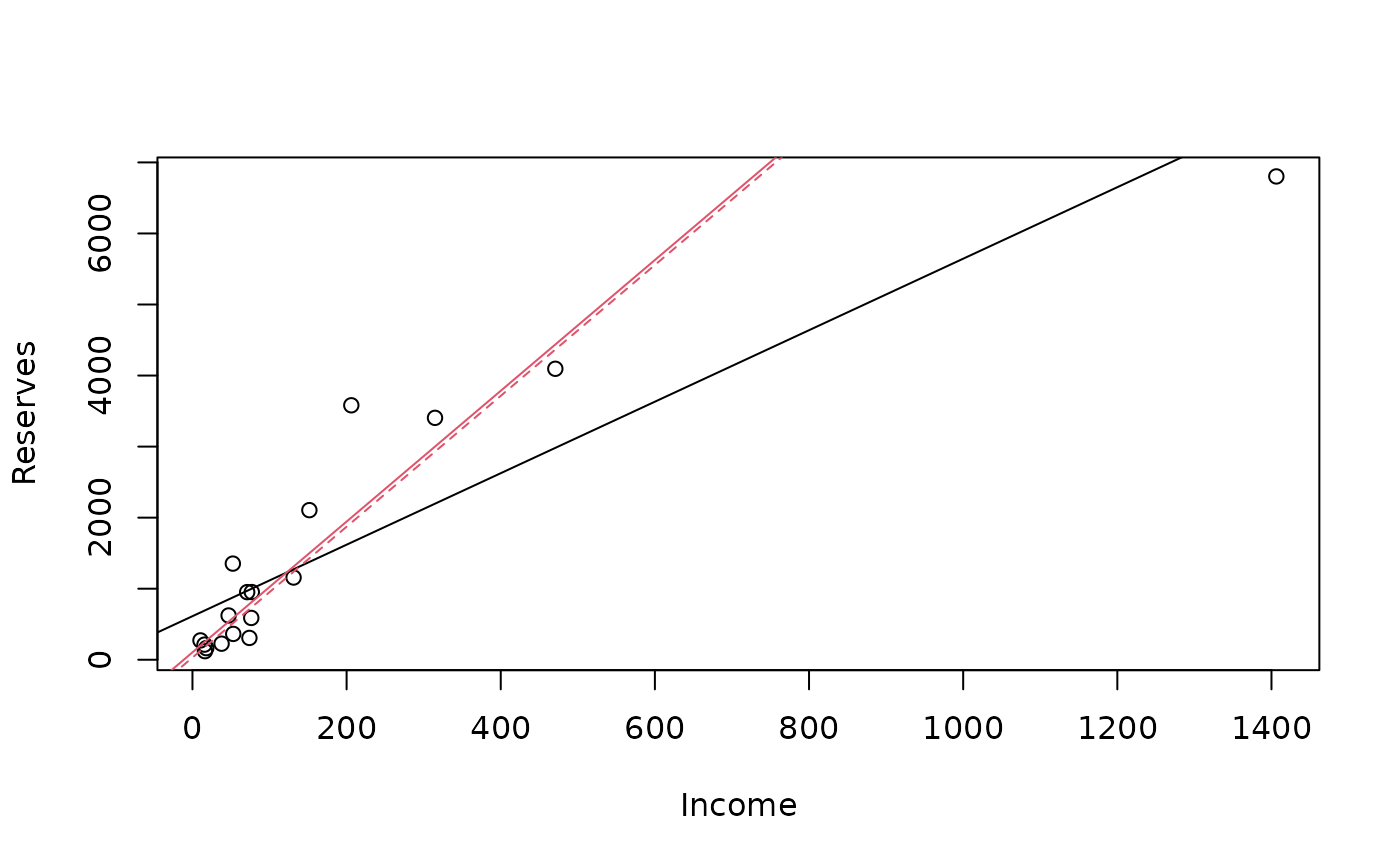

summary(lm.p <- lm(Reserves ~., data=pension))

#>

#> Call:

#> lm(formula = Reserves ~ ., data = pension)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -886.3 -533.5 -309.6 352.8 1931.4

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 613.0206 216.6178 2.830 0.0121 *

#> Income 5.0316 0.5916 8.505 2.48e-07 ***

#> ---

#> Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

#>

#> Residual standard error: 801.2 on 16 degrees of freedom

#> Multiple R-squared: 0.8189, Adjusted R-squared: 0.8076

#> F-statistic: 72.34 on 1 and 16 DF, p-value: 2.483e-07

#>

summary(lmR.p <- lmrob(Reserves ~., data=pension))

#>

#> Call:

#> lmrob(formula = Reserves ~ ., data = pension)

#> \--> method = "MM"

#> Residuals:

#> Min 1Q Median 3Q Max

#> -6245.07 -223.74 -69.83 180.69 1580.51

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 103.9083 97.5007 1.066 0.302

#> Income 9.2042 0.9429 9.761 3.84e-08 ***

#> ---

#> Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

#>

#> Robust residual standard error: 352.9

#> Multiple R-squared: 0.9156, Adjusted R-squared: 0.9103

#> Convergence in 10 IRWLS iterations

#>

#> Robustness weights:

#> observation 18 is an outlier with |weight| = 0 ( < 0.0056);

#> one weight is ~= 1. The remaining 16 ones are summarized as

#> Min. 1st Qu. Median Mean 3rd Qu. Max.

#> 0.007457 0.873200 0.964300 0.863500 0.986100 0.996200

#> Algorithmic parameters:

#> tuning.chi bb tuning.psi refine.tol

#> 1.548e+00 5.000e-01 4.685e+00 1.000e-07

#> rel.tol scale.tol solve.tol zero.tol

#> 1.000e-07 1.000e-10 1.000e-07 1.000e-10

#> eps.outlier eps.x warn.limit.reject warn.limit.meanrw

#> 5.556e-03 2.558e-09 5.000e-01 5.000e-01

#> nResample max.it best.r.s k.fast.s k.max

#> 500 50 2 1 200

#> maxit.scale trace.lev mts compute.rd fast.s.large.n

#> 200 0 1000 0 2000

#> psi subsampling cov

#> "bisquare" "nonsingular" ".vcov.avar1"

#> compute.outlier.stats

#> "SM"

#> seed : int(0)

summary(lts.p <- ltsReg(Reserves ~., data=pension))

#>

#> Call:

#> ltsReg.formula(formula = Reserves ~ ., data = pension)

#>

#> Residuals (from reweighted LS):

#> Min 1Q Median 3Q Max

#> -404.1 -129.2 0.0 199.6 839.9

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> Intercept 30.7415 119.5759 0.257 0.801

#> Income 9.2091 0.7627 12.074 8.64e-09 ***

#> ---

#> Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

#>

#> Residual standard error: 365.7 on 14 degrees of freedom

#> Multiple R-Squared: 0.9124, Adjusted R-squared: 0.9061

#> F-statistic: 145.8 on 1 and 14 DF, p-value: 8.641e-09

#>

abline( lm.p)

abline(lmR.p, col=2)

abline(lts.p, col=2, lty=2)

## MM: "the" solution is much simpler:

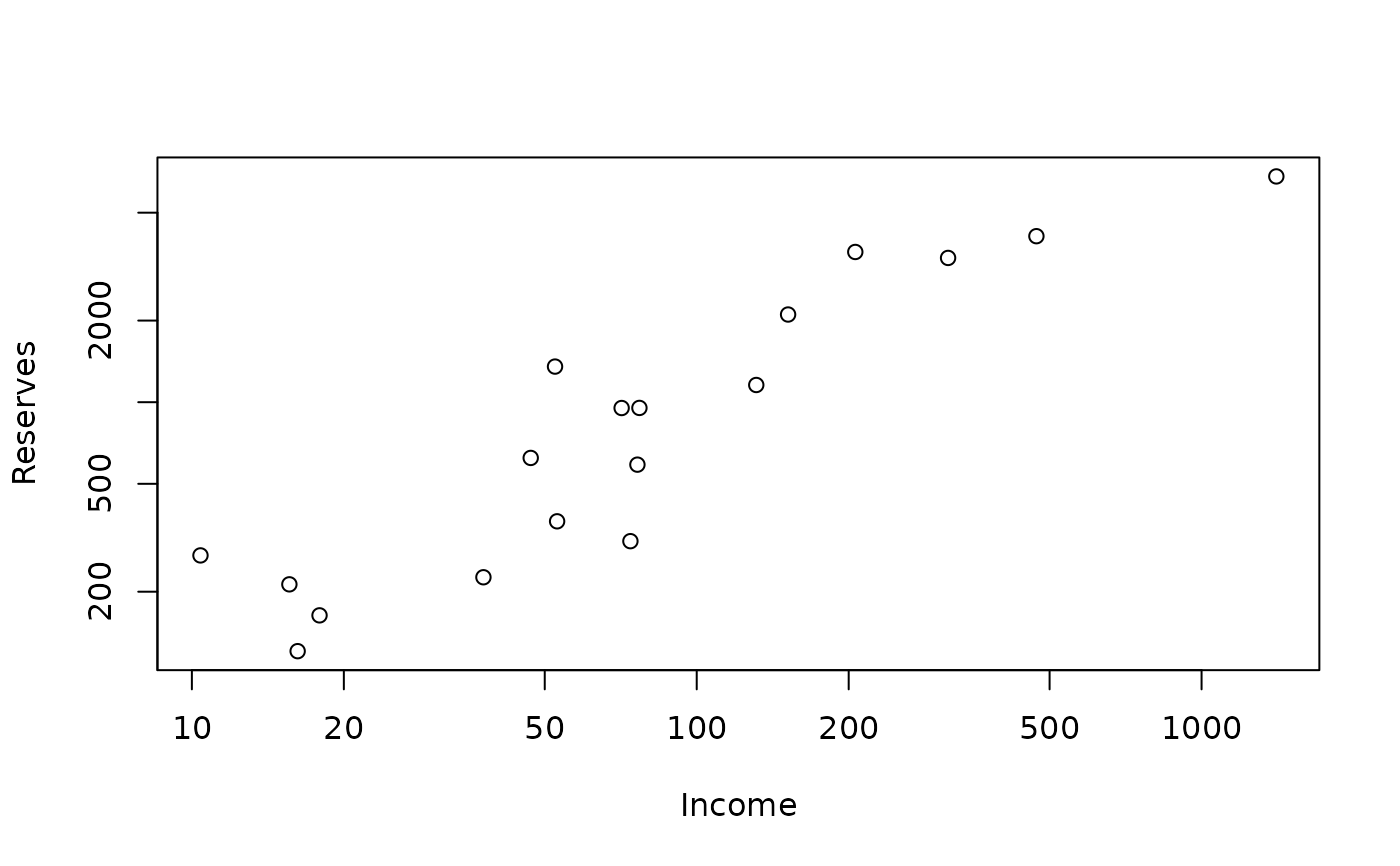

plot(pension, log = "xy")

## MM: "the" solution is much simpler:

plot(pension, log = "xy")

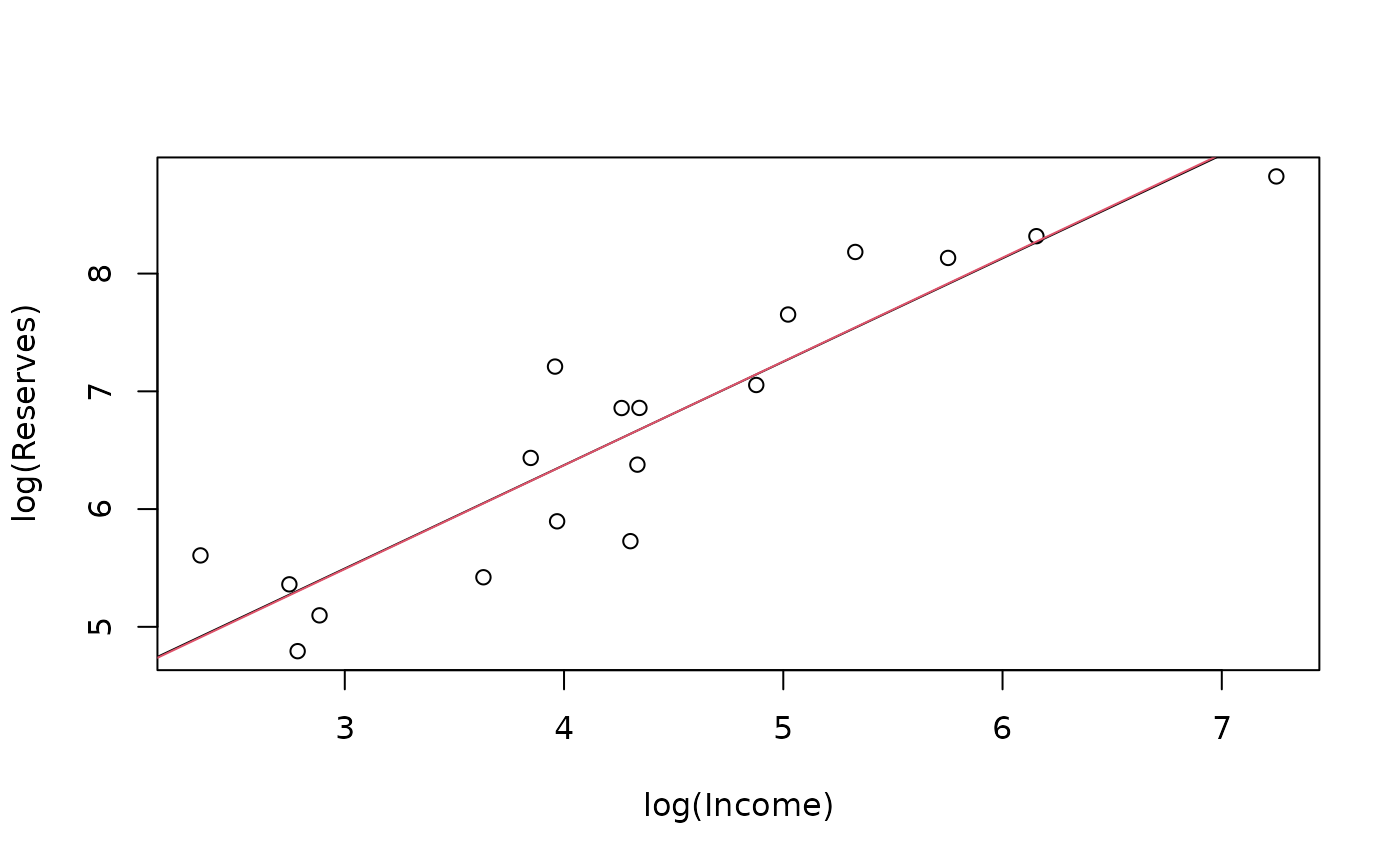

lm.lp <- lm(log(Reserves) ~ log(Income), data=pension)

lmR.lp <- lmrob(log(Reserves) ~ log(Income), data=pension)

plot(log(Reserves) ~ log(Income), data=pension)

## no difference between LS and robust:

abline( lm.lp)

abline(lmR.lp, col=2)

lm.lp <- lm(log(Reserves) ~ log(Income), data=pension)

lmR.lp <- lmrob(log(Reserves) ~ log(Income), data=pension)

plot(log(Reserves) ~ log(Income), data=pension)

## no difference between LS and robust:

abline( lm.lp)

abline(lmR.lp, col=2)